Sept 15, 2022, 15:25

Since the establishment of the Bretton Woods system in 1944, the US dollar has been the global reserve currency. Even when the United States terminated convertibility of the dollar to gold, effectively bringing the Bretton Woods system to an end and making the greenback a flat currency, the dollar's global hegemony continued.

Since 1971, the dollar's hegemony has been based mostly on one fact: almost all commodities in the world, especially oil, are traded in the dollar. Despite the growing economic problems of the US, including the stagnation of the income of the middle class, increasing inequality, and the ballooning of the country's national debt, the US has maintained its position as the largest economy in the world with high per capita GDP.

The collapse of the Soviet Union and the end of the Cold War ushered in a new era of US hegemony. In the 1990s and the 2000s, thanks to its economic and military power, the US adopted an assertive and aggressive foreign policy of "promoting democracy" across the world marked by NATO's bombing of Serbia, American invasion of Afghanistan and Iraq, and the destruction of Libya.

However, the 2008 global financial crisis marked the beginning of the end of the US' absolute hegemony. The US' decline and "the rise of other economies", primarily China, but also Russia, India and Brazil challenged American primacy. The establishment of new international organizations and groupings, such as the Shanghai Cooperation Organization, BRICS and BRICS-plus has created new platforms to help establish a multipolar world.

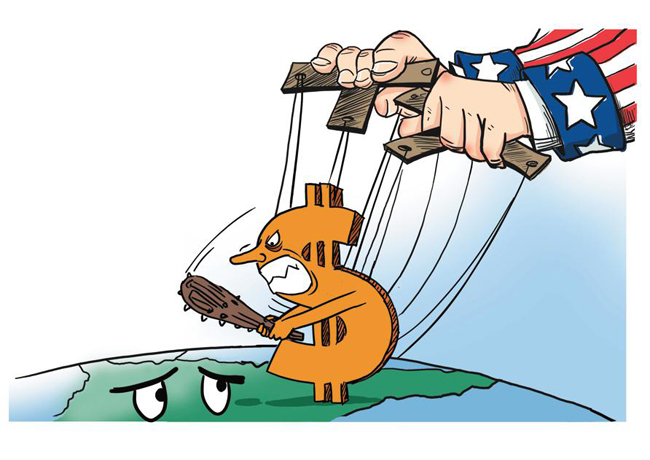

But as the US started facing growing competition from other centers of power, it decided to exploit the role of the dollar as a global reserve currency in a bid to contain the rise of other countries and maintain its hegemonic role worldwide.

To achieve its goals, the US used economic sanctions against other economies. The critical tool for the US was the introduction of the so-called "secondary sanctions", which targeted not only specific countries and companies but also third-party states and organizations. Using the dominant position of the dollar in the international market, the US threatened to exclude some countries and companies from the international financial system if they did not follow Washington's policies and diktats.

The first victim of this policy was Iran, which faced severe US economic sanctions. Now the US is using sanctions against China, particularly against Chinese telecommunications companies, such as Huawei and ZTE, which are significant competitors for US information and telecommunications technology giants in such areas as 5G networks and artificial intelligence.

Since February, the US and its allies and partners have imposed severe sanctions on Russia. Here again, the US exploits the role of the dollar as a global reserve currency, excluding Russian banks from international financial markets, and using secondary sanctions as a primary tool to force other countries to follow its rules and policies.

But since the economic situation of the US continues to deteriorate and the country's economy needs the injection of significant financial resources to stay afloat, the US Federal Reserve implemented an aggressive policy of interest rate hikes, thus stimulating the significant flow of capital from European and Asian markets to the US.

This policy resulted in a significant devaluation of many countries' currencies including the euro, which reached its lowest level in the last 20 years. The US' aggressive financial policy triggered significant inflation in many countries, causing widespread economic disruptions and a rise in poverty, especially in the developing world.

However, as the US government has been more often using the dollar as a primary tool to safeguard its geopolitical interests and contain the rise of other economies, the trust in the dollar is declining, and many developing countries have been trying to abandon the dollar as the primary currency for trade.

While China and Russia have started using the yuan and ruble as mediums of exchange in bilateral trade, Saudi Arabia is considering using the yuan as a negotiable instrument in its oil trade with China. And Egypt has decided to issue yuan-denominated bonds.

Also, countries such as India and Iran are discussing the possibility of using their national currencies in regional and international trade. This means that despite the dollar still being the most common global reserve currency, the process of de-dollarization in global trade has accelerated. Incidentally, the US policy of using the dollar as a tool of economic coercion and geopolitical confrontation significantly accelerated this process.

The post-Cold War order will result in the establishment of a truly multipolar world and the end of the US' absolute hegemony. It could also mark the end of the position of the dollar as the leading and strongest global reserve currency.

The author is chairman, Center for Political and Economic Strategic Studies, Yerevan, Armenia.

First, the world must do away with US and US Dollar as the determinators for prices of commodities and terms of payment.

Countries should be free to transact in common currencies decided by the majority of the countries engaged in trade.

US market share is dwindling significantly. Most important to note is the US owes some Three Hundred Trillion in debt to the world not the world owes US. If the world were to claims from US now, then US will bankrupt. The world should allow US to seek bankruptcy protection to stay afloat.

US controls and dictates all commodities traded across the world. Using US Dollars as the basis for pricing them, it ensures that all payments must be made in and through it by clearance.

The world is therefor at its mercy. Any nation whose diplomatic relations with US if jeopardizes will face punitive measures. For some drastic turns could turn into a place not suitable for living for years ahead. Haiti is an excellent example.

US greenback is just a mere piece of paper printed as promissory note and protected by its dominating military forces above law to deliver destruction and devastation to any nation that do not comply with its so called rules.

USSR was dissolved by it. EU is under stress from it. Countries in South America, Africa and Asia had been blended nicely by it.

A rule is maintained till today, that only US citizens could be the chiefs of World Bank and International Monetary Fund as dictated by US.

If this is NOT HEGEMONY, please use another fancy term to those who know not about the rules of the games!

I agree with this article, but it is important to point out that the dollar is a fiat currency, not a flat currency!

The de-dollarization of global trade is undoubtedly gaining momentum, but we need only to look at Libya to see how the U.S. will react.

“In 2009, Colonel Gaddafi, then President of the African Union, suggested to the States of the African continent to switch to a new currency, independent of the American dollar: the gold dinar. The objective of this new currency was to divert oil revenues towards state-controlled funds rather than American banks. In other words, to stop using the dollar for oil transactions. Countries such as Nigeria, Tunisia, Egypt and Angola were ready to change their currencies. Unfortunately in March 2011, the NATO-led coalition began a military intervention in Libya in the name of freedom….”

The USA will do everything in their power to prop up the dollar, and we can only hope that the global community unites against any more U.S. led ‘interventions’.

To cover up their otherwise undisguised gangsterism, they peddle a constant tsunami of horse-manure:

1. Queen Elizabeth, 96 – US$600 million

She may be 96, but the much celebrated queen is still going strong – she also has US$600 million in the bank. According to the BBC, Queen Elizabeth collected US$105 million from British taxpayers via the Sovereign Grant between 2021-2022 – the equivalent to around US$1.5 per person. It excludes the cost of Metropolitan Police security for the royals and the grant fluctuates every year.

- 15 richest British royal family members’ net worths, ranked: from Queen Elizabeth’s US$100 million taxpayer income and Kate Middleton’s trust fund, to Meghan Markle and Prince Harry’s Apple TV+ gig

Note the switcheroo. Despite clearly citing the "net worth" in the title, it then goes on to only state the "US$600 million in the bank." The "still going strong" monarch popped her clogs, a month after the above.

That's from mainland bashing South China Morning Post, which is based in Hong Kong. Asia Times Online, which is also based in Hong Kong, but which jewish Amerikan, David P. Goldman, admits he's commandeered, also spouts total crap, even more absurd than usual as the war-propaganda against Russia.

Even as Prince of Wales, Prince Billy inherets about £1bn, with Charlie inheriting FAR MORE and all free of inheritance tax. Such dual standards is, of course, oppression.

When prince charles turned 65 back in 2013, the age at which Britons were then entitled to their state pension, he announced that he would give his £110 (then $177) per week to charity.

. . .

In 2022 the duchies’ assets are worth a combined £1.7bn, and they made profits of around £47m between them.

- What King Charles could mean for the royal finances

So they take £100m from the taxsucker each year despite being possessing billions in un-earned riches.

As the poodle anthem claims, he is "our gracious king". We, his subjects, will share out the £110 a week between the 63 million of us. Perhaps we can all simply touch the "worthless paper" notes bearing his likeness or just get to see them posted online. Just as gracious is admitting their crimes were "abhorrent" and then not even offering an apology, never mind reparations. Even in Poodleville MANY say, "Not my king" and Prince Billy was booed at a football match.

It is inherently fraudulent for the Great Satan and poodle to impose their paper funny-money on the World and claim nations hold it as a "reserve" asset. Both parasite, thieved nations could always borrow by issuing bonds. Instead, they borrow at zero interest rates with the "worthless paper" USD, which only they can print out of "thin air".

This is straightforward gangsterism.

But as China and Russia have announced, this era is now over and there is no going back.

Community login

Add a comment